The Dependency Economy of AI

Why sovereignty is becoming the new competitive frontier — and what 25 national strategies reveal about the world’s real chokepoints.

By Asia Tech Lens

(Adapted from research by Damien Kopp)

This article distills the key insights from Damien Kopp’s white paper, providing a high-level look at the sovereignty fault lines shaping the global AI landscape.

Digital sovereignty has moved from think-tank jargon to a boardroom worry. Governments are throwing billions at “sovereign AI” programs, enterprises are racing to localize data and train internal models, and countries across Asia and Europe now speak about AI with the urgency usually reserved for energy security or supply-chain resilience.

Yet the global AI build-out hides a structural contradiction that the new white paper, The Dependency Economy of AI, surfaces with unusual clarity: most of the world’s ambitions for autonomy still sit on hardware, models, and cloud stacks they do not control.

This is the Sovereignty Paradox—and it defines the next decade of AI geopolitics.

The world wants sovereignty. Only two countries have it.

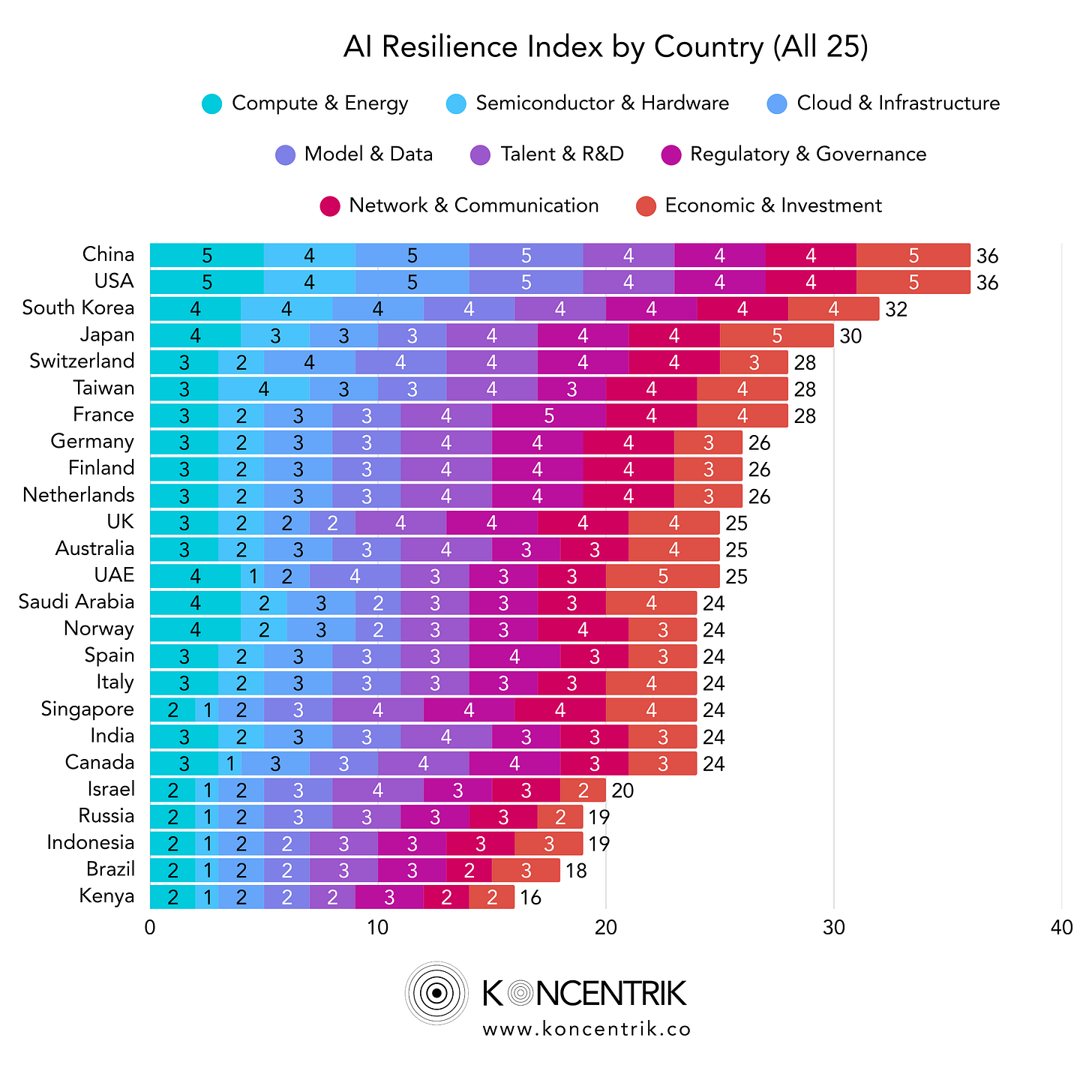

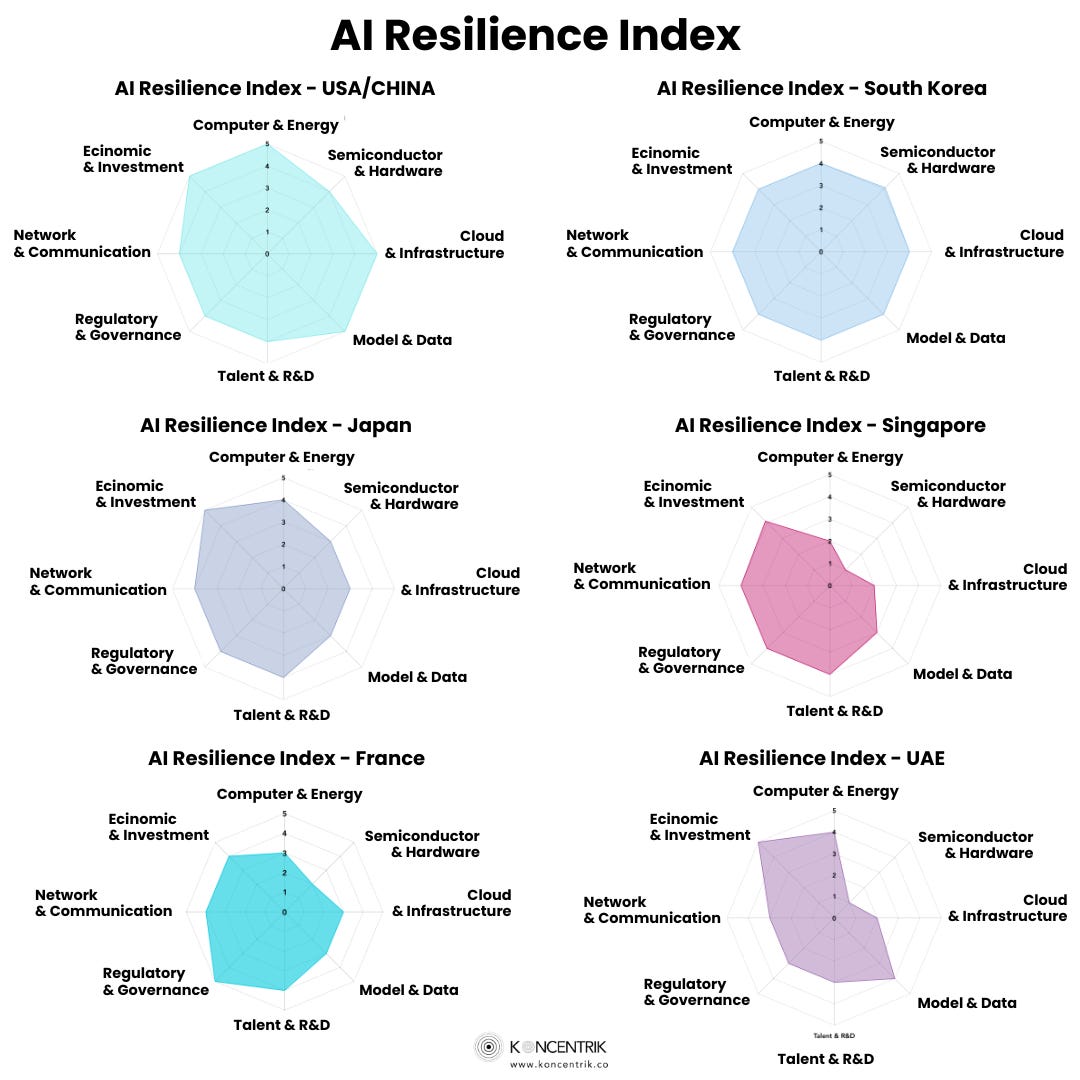

The analysis compares 25 national AI strategies across eight dimensions of “resilience”—from chips and compute to cloud autonomy and linguistic models. The conclusion is blunt:

Only the US and China operate near full-stack AI ecosystems.

They design the chips, control fabrication (directly or indirectly), run the dominant clouds, and build the frontier models.Everyone else is managing dependencies, not eliminating them.

Even countries with ambitious “sovereign AI” rhetoric still rely on imported GPUs, foreign hyperscalers, or model APIs controlled abroad.

The aggregated index makes the pattern obvious: the US and China sit alone at the top of the resilience curve, followed by hybrid ecosystems like South Korea, Japan, France, Switzerland, and Taiwan—each strong in some layers, dependent in others.

Four sovereignty models are emerging

The comparison across 25 countries reveals four distinct “archetypes”:

1. Partnership-Based Sovereignty (Speed over Autonomy)

UAE, UK, Norway, Australia, Indonesia

These countries gain rapid capability through tight alignment with US vendors—OpenAI, NVIDIA, Microsoft, Oracle.

They get scale fast, but the core stack remains foreign-controlled.

Operational sovereignty, not technological sovereignty

2. Regulatory Sovereignty (Control through Law)

Europe: France, Spain, Switzerland, Germany, Italy, Netherlands, Finland

Europe can’t outspend the US or China, so it tries to govern the stack it uses: S3NS in France, Phoenix in Switzerland, ALIA in Spain.

Strong on regulation and compliance; structurally dependent on US chips and cloud stacks.

3. Full-Stack or Hybrid Sovereignty (Asia’s Big Bet)

China, South Korea, Japan, Taiwan

The only path that actually shifts dependency: massive investment across chips, models, compute, energy, and talent.

This is expensive, slow, politically difficult—but structurally credible.

South Korea’s NPUs, Japan’s Rapidus 2 nm fab, China’s DeepSeek and Ascend ecosystem illustrate this intent.

4. Open-Yet-Local Sovereignty (Inclusion over Frontier)

India, Singapore, Brazil

A model that prioritizes linguistic coverage, public infrastructure, and local control of data—without claiming full-stack independence.

SEA-LION (Singapore) and Bhashini (India) are the clearest examples.

They accept GPU dependency but build social and linguistic leverage.

The GPU chokepoint: the hard boundary of sovereignty

NVIDIA controls 94% of the discrete GPU market.

Every national strategy—from the UAE to France to Singapore—eventually runs into this wall.

Even “sovereign clouds” are sovereign only in geography, not hardware.

A data center may sit on national soil, but the chips inside it remain governed by US export rules, firmware, and supply-chain control.

Only three economies (South Korea, Japan, China) are making real moves at this layer.

Everyone else is exposed.

The next big battlegrounds: energy, language, and alignment

One of the paper’s strongest contributions is expanding sovereignty beyond chips:

Energy becomes a sovereign advantage

Countries like Norway, Saudi Arabia, and the UAE use cheap and abundant energy to compete for the global AI hosting market.

Compute is increasingly an energy business.

Language becomes a competitive moat

India, Singapore, Spain, Mexico—multilingual societies are recognizing that linguistic sovereignty defines market reach and national inclusion.

A model that speaks your language becomes part of your infrastructure.

Governance becomes the new control plane

Europe shows that you can’t buy GPUs, but you can set the rules for how they’re used—and force platforms into compliance.

Key Findings from the White Paper

Here are the white paper’s seven core conclusions that synthesize the battlegrounds and sovereignty models above:

Sovereignty claims exceed actual autonomy

Chips dominate every sovereignty model

Energy is the new geopolitical moat

Language is becoming a competitive advantage

Regulation is Europe’s main leverage

Parallel ecosystems are here to stay

Dependencies are irreversible without long-term strategies

Why this matters for companies: AI is now a supply chain

Only 15% of organizations treat AI sovereignty as a CEO-level concern (cited in the foreword).

Meanwhile:

API models get deprecated with little warning

Export controls reshape cloud regions

Vendor pricing changes disrupt P&Ls

Energy shocks can shut down training pipelines

Cloud jurisdiction dictates who can subpoena your data

The white paper proposes a shift from “AI adoption” to “AI resilience planning.”

A six-step playbook outlines how enterprises can map dependencies, test failure modes, design alternatives, and modernize governance to handle geopolitical risk.

What enterprise leaders should do now

The paper is explicit: AI can no longer be treated as a single technology decision. It behaves like a geopolitically exposed digital supply chain—reliant on layers you don’t own and external vendors whose roadmaps sit outside your control.

A few practical actions emerge from the research:

1. Map your dependencies with the same discipline as physical supply chains.

Most organizations don’t actually know which jurisdictions govern their data, which vendors control their APIs, or which GPU supply chains power their workloads.

A dependency inventory is now as important as a risk register.

2. Build model optionality into every critical workflow.

Relying on a single foundation model (or a single API endpoint) creates silent fragility.

Enterprises need interchangeable paths: open-weight models, regional models, and local inference where possible.

3. Treat cloud choice as a legal dependency, not an IT decision.

Cloud regions determine who can subpoena your data.

Segment sensitive workloads accordingly—regulated, sensitive, and non-sensitive—and ensure rapid portability across regions or providers.

4. Stress-test for discontinuities, not just outages.

Enterprises already simulate data-center failures.

They now need to simulate export controls, API depreciation, pricing shocks, and vendor policy changes—exactly the kind of disruptions that sovereignty tensions create.

5. Localize what matters: data, fine-tuning, and linguistic alignment.

If the model speaking to your customers uses a linguistic or cultural baseline from another region, you don’t control the user experience.

Linguistic sovereignty is emerging as a serious commercial asset in Asia.

These are not attempts at purity. They are attempts at resilience—the ability to pivot when conditions shift, without rewriting your entire stack.

Asia’s emerging playbook

One of the most interesting patterns in the analysis is Asia’s divergence:

China has built a fully parallel stack

South Korea is the closest to full-stack autonomy among democratic countries

Japan is executing a dual-track model: Rapidus + OpenAI

Singapore and India are pioneering linguistic sovereignty as a form of power

UAE shows what high-speed, partnership-driven capability can look like—with clear limits

These strategies aren’t converging; they’re diverging.

The global AI ecosystem is fracturing into parallel, politically aligned stacks, and enterprises operating across Asia will increasingly need to navigate them like they navigate financial or logistics networks.

The bottom line: resilience, not purity

The white paper concludes with a simple but important point:

True AI sovereignty remains aspirational. The realistic goal is resilient dependence—the ability to pivot when conditions change.

For national governments, that means intentional trade-offs.

For enterprises, it means treating AI not as a tool, but as a geopolitically exposed digital supply chain.

Full White Paper (Download)

For a country-by-country analysis, data visualizations, and the full 25-nation AI Resilience Index, download the complete white paper:

The Dependency Economy of AI by Damien Kopp

About the Author

Damien Kopp is a Singapore-based strategist specializing in AI, digital transformation, and technopolitics. He is the Managing Director of RebootUp, where he advises governments, financial institutions, and Fortune 500 companies on building resilient, sovereign-ready AI architectures.

With more than 25 years of experience across Europe, North America, and Asia, Damien works at the intersection of technology, geopolitics, and organizational design—helping leaders navigate a world where AI infrastructure has become a strategic dependency.

He is also the founder of KoncentriK, a thought-leadership platform exploring the deeper structural forces shaping the digital future, and an Associate Faculty member at Singapore Management University, where he teaches applied AI to senior executives.

Damien holds an Executive MBA from Kellogg–HKUST and a Master’s in Electronics Engineering from ESME Sudria.

For Damien’s full research, follow KoncentriK.

Brilliant deep dive into the sovereignty paradox. Your framing of resilient dependence as the realistic goal rather than pure autonomy really cuts through alot of the aspirational noise in national AI strategies. The GPU chokepoint analogy is especially sharp because it makes visible just how thin the layer of actual sovereingty is even when datacenters sit on local soil. What's interesting is how energy and linguistic moats might create new leverage points outside the semiconductor trap entirely.