Hot Chips, Cool Solutions: Asia’s Race to Reinvent Data Center Cooling

With AI workloads running hotter and denser, Asia’s data centers are experimenting with new ways to cut energy use and emissions

Editor’s Note: In August, we asked if Southeast Asia was truly ready for an AI data center surge, given power shortages and rising costs. This week, we zoom in on one of the biggest bottlenecks: cooling, which can swallow a substantial chunk of a facility’s energy bill.

Data centers are critical to the digital economy, but the servers packed into racks generate so much heat that they need constant cooling. Without it, chips slow down, hardware fails, and energy bills spike.

Typically, about 40% of a data center’s energy goes into cooling. For years, the default has been air-based systems: chillers and fans that push cooled air through the racks. It works, but it’s inefficient, and the ever-increasing demands of AI are exposing its limits. Then there’s water. Many facilities depend on freshwater sprayed, evaporated, or chilled and pumped around machines. Some data centers can consume hundreds of thousands of gallons a day.

And the demand keeps rising. Training AI models, running high-frequency trading platforms, powering video streaming, and supporting cloud gaming all create dense workloads that push cooling systems to the limit. From banks in Hong Kong to chipmakers in Taiwan and AI labs in China and Japan, industries across Asia are competing for stable, low-latency infrastructure that can stay cool under pressure.

That’s why operators are moving beyond traditional methods. Some are trying immersion tanks, submerging entire servers in non-conductive fluid to draw heat out more directly. Others are testing direct-to-chip systems, piping coolant right to the hottest components. The most advanced setups use precision liquid cooling, blending both methods to cut water use, lower emissions, and even recycle heat for other uses.

China’s Push for Smarter, Cooler Data Centers

The shift is already happening fastest in Asia. In China, the scale of investment shows how fast this is moving. The data center cooling market is valued at USD 371.6 million in 2025 and is projected to more than double to USD 830.4 million by 2030.

“China’s ambitious approach signals a bold shift toward low-carbon digital infrastructure, and it could influence global norms in sustainable computing,” Shabrina Nadhila, an analyst at the energy think tank Ember, told Live Science.

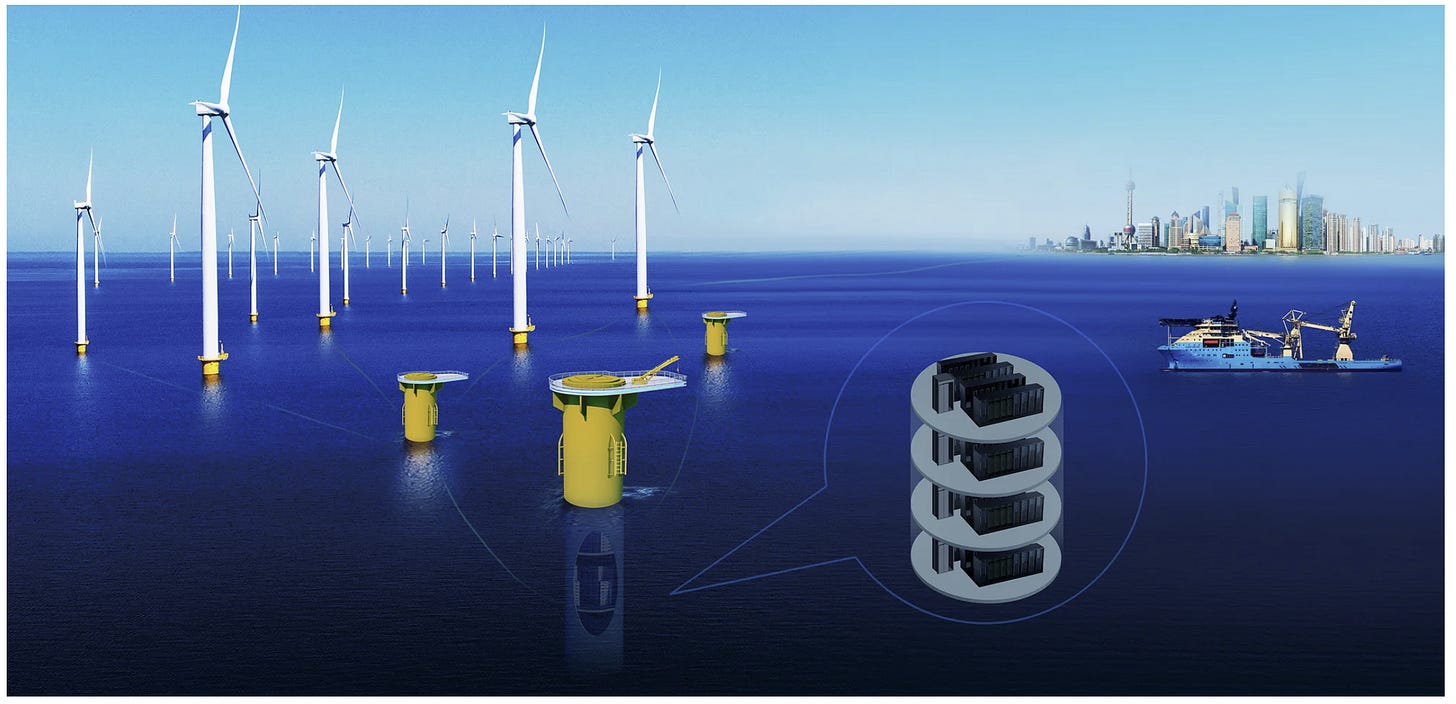

Underwater Data Centers

One of the most eye-catching examples is underwater. Off the coast of Shanghai, start-up Hailanyun has deployed what it calls the world’s first commercial underwater data center. Its sealed pods use seawater radiators instead of air conditioning, cutting power use by more than 30%. The first operational pod holds 198 racks, supporting up to 792 AI-ready servers, enough for large-scale model training.

The Growth of Liquid Cooling Technology

On land, China is emerging as one of the world’s largest markets for liquid cooling, propelled by the growth of AI, 5G, and cloud services. Unlike air systems that move cooled air around racks, liquid cooling transfers heat directly through fluids in contact with chips, a method long used in aerospace but only recently scaling in data centers.

Alibaba has been experimenting with immersion systems since 2015, reporting cooling energy cuts of up to 70% with its “soaking server” design, and more recently introducing hybrid setups that mix air and liquid to handle denser AI racks. Tencent has tested liquid-cooled micro-modules alongside airflow optimization to manage high-density computing while keeping power use in check.

Southeast Asia’s Cooling Experiments

If China is scaling, Southeast Asia is improvising under tighter resource limits.

In Singapore, where land is scarce and the climate is hot and humid, the government has set some of Asia’s toughest rules. In 2025, Singapore added a new rule which requires data centers to use more efficient IT equipment. The government says this can cut IT power use by 30% and allow servers to run safely at higher temperatures, up to 35°C, reducing the need for cooling. Singapore is one of the first countries in the tropics to set such standards. To meet this target in a land-scarce city, operators are turning to new ideas. Keppel Data Centres is developing floating data centers that sit offshore and use seawater. This cuts reliance on treated water and eases the strain on land. Keppel is also piloting ice-based thermal storage, producing ice during off-peak hours and using it later to cool servers, an approach it says can ease peak demand and improve overall efficiency.

Across the causeway, Malaysia is focusing on water. AirTrunk has partnered with Johor Special Water to develop the country’s largest recycled-water scheme, treating wastewater for reuse in cooling, with pilots targeting 50–70% cuts in freshwater demand. Other data center operators are pursuing reclaimed-water approaches in Johor, while in Cyberjaya new high-density campuses are being built liquid-cooling ready from the ground up.

In Thailand, operators are turning to overlooked energy sources and liquid cooling pilots. ST Telemedia Global Data Centres has unveiled a direct-to-chip cooling showcase in Bangkok to support high-density AI workloads, while earlier projects with PTT Digital tested reusing cold energy from LNG regasification to chill servers.

Japan: Cooling Innovation in a Growing Market

Japan’s data center market is expanding quickly, with IT load capacity forecast to approach 2,000 MW of IT load and 500,000 racks by 2030. This growth is driving strong demand for cooling, with the country’s data center cooling market estimated at USD 258 million in 2025 and projected to nearly double by 2031.

The Fugaku supercomputer already relies on liquid cooling, and Tokyo has pledged US$11 billion for carbon-neutral infrastructure, including subsidies for zero-carbon data centers. Operators are testing solutions from immersion cooling, where KDDI has reported cuts of more than 90% in cooling power — to simpler approaches like snowmelt and outside air in Niigata.

South Korea: Cooling with AI

Like Japan, South Korea is feeling the strain from rapid AI adoption. But instead of new hardware, it’s betting on software. LG Uplus is testing AI-driven digital twins at its Pyeongchon 2 data center to forecast heat loads and adjust cooling in real time, with trials targeting about a 10% cut in energy use.

But It’s Not Without Risks

Asia’s cooling experiments are bold, but they come with real challenges:

Environmental: Environmental groups and marine scientists have warned that warm-water discharge from underwater and seawater-cooled data centers could disrupt ecosystems already stressed by rising ocean temperatures.

Technical: Saltwater is highly corrosive, and even hardened casings degrade faster in marine environments. Biofouling, the buildup of algae and barnacles, can clog heat exchangers and raise maintenance costs.

Operational: Underwater pods make even routine fixes a logistical headache. Replacing a single faulty drive may require divers or robotic subs, and in some cases the entire module must be brought to the surface. Microsoft’s Project Natick showed that sealed capsules can operate reliably for years, but also highlighted how impractical upgrades and maintenance can be once equipment is submerged. On land, immersion tanks and liquid systems need specialized handling and monitoring, which can raise training and maintenance costs compared with familiar air-cooled setups.

Policy: Global standards for immersion and ocean-based cooling don’t yet exist. Countries set their own efficiency and safety rules, but the lack of harmonization leaves operators exposed.

Scaling: Cooling pilots often look impressive, but replicating them across hyperscale campuses is another matter. What works in a single pod or demo facility doesn’t always translate to multi-megawatt sites that need reliability 24/7. Operators also warn that upfront costs can be 20–30% higher than conventional builds, slowing adoption.

Economic: With margins tightening in the cloud and AI sectors, investors want to know whether these designs will truly pay off at scale. Energy savings may not offset higher capital costs unless paired with government subsidies, carbon credits, or long-term contracts with hyperscalers. Until then, many pilots risk being seen as experiments rather than bankable infrastructure.

Can Asia Lead the Way?

Across the world, cooling technology for AI data centers is entering a critical new phase. In the West, Microsoft’s Project Natick submerged data pods off Scotland, and Google recycles municipal wastewater at U.S. server farms. Yet most of their bold ideas remain experimental or limited in scale.

In Asia, the shift is happening faster, driven primarily by necessity. The data center cooling market in Asia Pacific is expected to reach a projected revenue of $25.4 billion by 2030, growing at an annual rate of 20% from 2025.

And the climate stakes are rising, too. Data centers already account for an estimated 1–2% of global electricity use, with cooling the single biggest contributor. That means every breakthrough, from seawater pods in China to floating centers in Singapore, is also a step toward national carbon targets. Japan has pledged net zero by 2050, China by 2060, and Singapore is aligning operators with its own green standards.

Why does this matter globally? Because if Asia succeeds, it could reshape three fronts at once.

Breakthroughs here could make AI training cheaper in Asia

Strict national programs mean the region is stress-testing how to scale compute while staying within water and carbon limits, lessons that regulators elsewhere may borrow.

Bankability now hinges on cooling compliance, giving efficient operators an edge in attracting hyperscalers and AI labs.

Standards for immersion and ocean-cooled systems are still being shaped, and questions around water use and environmental impacts remain unresolved. Yet Asia’s rapid pace, driven by necessity and regulation, is positioning the region to set new benchmarks in digital infrastructure. The next frontier in AI may not be faster chips but cooler ones, and Asia might just race ahead.

For More Info on Asia Tech Lens