Singapore’s Quantum Bet: Where AI Meets the Next Compute Revolution

Singapore is betting big on Quantum AI — from Horizon’s SPAC to Quantinuum’s rollout — to anchor Asia’s next wave of compute amid rising security and geopolitical risks.

News broke in September: Horizon Quantum Computing, a homegrown startup that turns classical code into quantum logic, plans a US$500 million SPAC. It signaled a bigger bet for Singapore—one that unites deep-tech ambition with national strategy.

Quantum-AI runs parts of AI on quantum resources to get better answers on messy, high-dimensional problems. Early adopters sit in finance, pharma, manufacturing, energy, and logistics. Think of a trading model estimating whether a bond order gets filled—HSBC and IBM tested one and saw up to a 34 percent improvement in prediction accuracy.

Why now? AI is hitting limits on power, data, and model size. At the same time, early quantum machines and simulators are in the cloud, and tools like PennyLane and TensorFlow Quantum let teams slot small quantum routines into normal ML code.

Where others see the limits of silicon, Singapore sees an opening—a chance to host the moment AI and quantum finally touch. With national funding and industry–academic bridges, it is positioning itself as Asia’s Quantum-AI bridge between the US, China, and Europe.

Singapore Scene

Anchoring this effort is the National Quantum Strategy, a S$300 million plan funding four main initiatives: the Centre for Quantum Technologies (CQT), the Quantum Engineering Program 3.0 (QEP 3.0), the National Quantum Processor Initiative (NQPI), and the National Quantum Scholarship Scheme (NQSS). Together, they form the backbone for hardware, algorithms, and talent—but more importantly, they signal Singapore’s approach: building a complete stack before chasing hype.

Around that core, EnterpriseSG is building the commercial bridge. In 2025, QAI Ventures opened its Asia-Pacific HQ in Singapore, with an EnterpriseSG-backed accelerator and venture builder—a move that shows where early-stage quantum startups now go to find both funding and physical access to hardware.

For startups like Horizon, global scale depends on access—to both capital and compute. That’s exactly the bridge Singapore is trying to build.

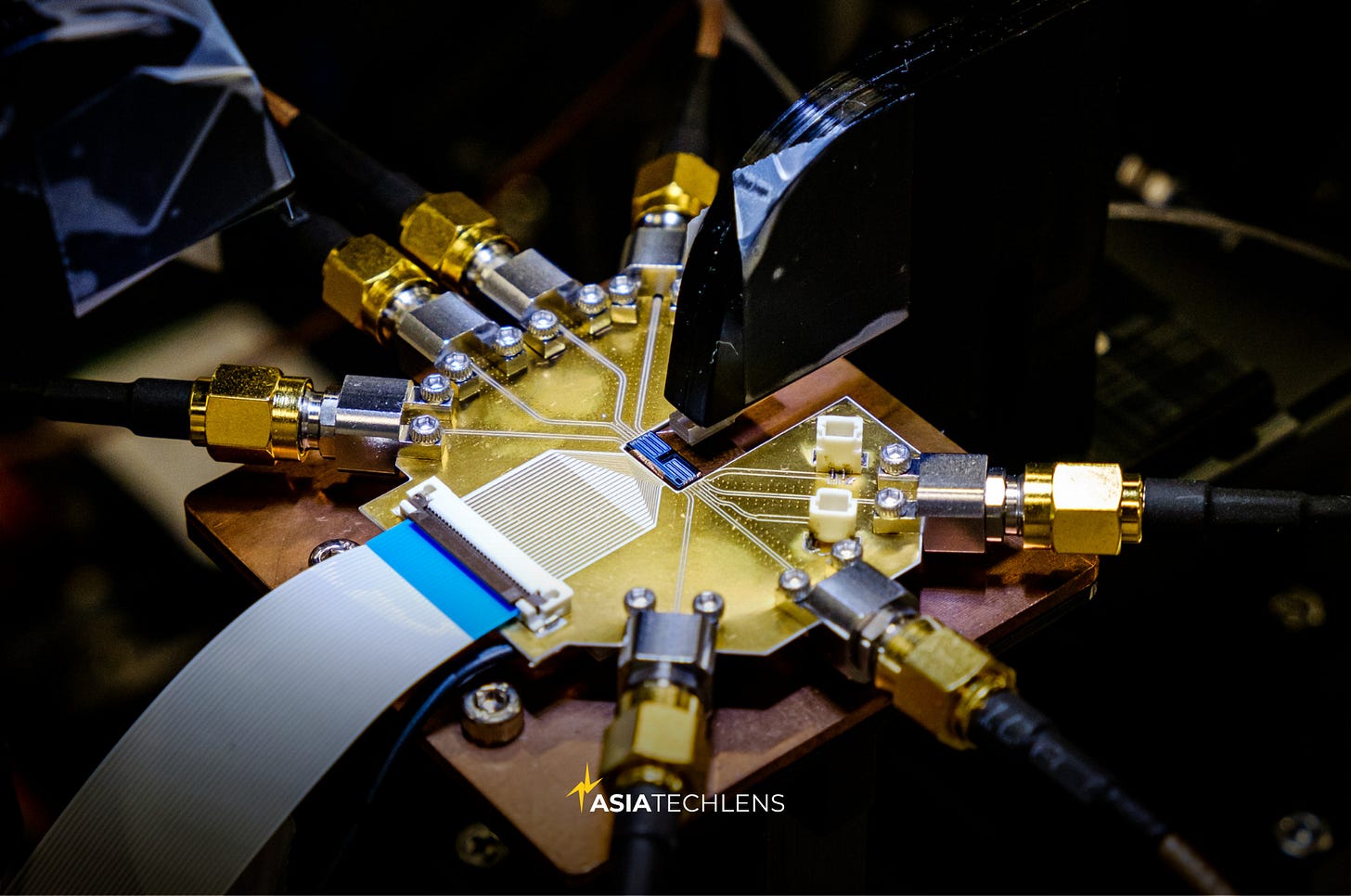

Industry links and hardware inflows are gathering pace. Quantinuum, a US-UK firm building quantum hardware and software, is bringing its general-purpose Helios system to Singapore in 2026, along with a new R&D and operations center to support talent development and commercial innovation.

IBM Quantum continues research tie-ups with NUS and the Defence Science and Technology Agency, while Horizon Quantum Computing scales globally. Local access to real hardware lets teams move beyond simulations and test hybrid workflows against live devices.

“Singapore has demonstrated remarkable foresight in recognizing the transformative power of quantum computing in this next phase of technological progress,” says Dr. Rajeeb Hazra, President and CEO of Quantinuum, on its new partnership with the National Quantum Office.

Quantum computing’s power is also its risk: it threatens today’s encryption. In finance, that means banks and regulators need to start shifting to quantum-resilient systems.

As HSBC Singapore COO Tancy Tan wrote in The Straits Times, banks, regulators, researchers, and tech partners should “test solutions together, set shared standards, and keep the financial system secure and future-ready.”

A practical first step is crypto agility—the ability to switch encryption systems quickly—inventorying where sensitive data lives and swapping in quantum-safe algorithms as standards mature.

Talent is just as critical. Singapore needs both deep technical experts and translators who can turn quantum breakthroughs into commercial and regulatory language.

Global Race

The race to define Quantum-AI is no longer theoretical—it’s about who controls the algorithms, the hardware, and the standards that will shape the next era of intelligence.

The United States is pulling ahead through private-led partnerships, with Big Tech commercializing access to quantum processors and software kits. Export controls on AI chips and quantum components are redrawing the global map of compute access.

China is pushing quantum through a state-led strategy backed by about US$15 billion in public funding. Its 14th Five-Year Plan and Vision 2035 fold quantum into a broader roadmap covering AI, photonics, advanced manufacturing, and new materials—and call for national labs in quantum information, photonics, micro- and nano-electronics, and network communications.

Europe adds a third track. The EU’s Quantum Flagship emphasizes open science, cross-border consortia, and responsible computing, offering Singapore another avenue for joint projects, talent exchanges, and standards work. Commercial players like Oxford Quantum Circuits (OQC), Pasqal, and IQM anchor the ecosystem.

The Road Ahead

This divergence creates both opportunity and squeeze for Singapore.

Neutrality and open collaboration let it work with U.S., Chinese, and European partners.

But because a quantum breakthrough anywhere can undermine encryption everywhere, cyber risk is shared, not local. And as controls extend to some quantum gear and limit access to advanced chips, moving talent and compute across borders gets harder—from licensing to hiring.

As Minister for Digital Development and Information Josephine Teo put it at Singapore International Cyber Week in October:

“A breakthrough in quantum computing anywhere affects encryption everywhere. A vulnerability in one country’s systems can cascade globally. This means international cooperation must turn from principle to practice.”

Singapore’s bet is to stay indispensable—a trusted node where talent, research, and commercialization intersect.

Whether the future of computing is quantum, hybrid, or something else, Singapore wants to make sure it’s not left waiting for access—or left out of the room where the algorithms are written.