How India Made Quick Commerce a Way of Life

10-minute delivery is no longer a perk, it’s a common feature in urban centres such as Delhi, Mumbai and Bengaluru

Craving ice cream at midnight? Missing an ingredient while cooking? Need a last-minute gift? In India’s metros like Delhi, Bengaluru and Mumbai, these emergencies are now non-events. Open an app, tap a few buttons, and in as little as 10 minutes, it’s at your door.

No hassle, no stress, no traffic to worry about.

What began with groceries now includes essentials and even Sony PlayStations (yup, you read that right). In fact, 15–20% of quick commerce gross merchandise value (GMV) now comes from general merchandise, phones, electronics, and apparel. In March 2025, India clocked between 4.15 and 4.45 million quick commerce orders per day - that’s double the previous year’s volume.

Quick commerce isn’t new globally, but “quick” varies by markets. In the U.S., it’s typically 30–45 minute delivery in select urban zones. China’s Meituan and JD Daojia normalized 30–60 minute delivery, though recent regulatory scrutiny has slowed the race for ever-faster speeds.

A Quick Primer on Quick Commerce

Before we dive further into the story, let’s clarify how quick commerce, or q-commerce, differs from e-commerce or food delivery.

Business Standard defines q-commerce as a unique business model where the delivery of goods and services is done within 10-30 minutes of ordering. Also known as ‘on-demand delivery’, the business focuses on smaller quantities of goods such as groceries, toiletries, over-the-counter meds, and other everyday essentials.

Unlike e-commerce, which ships from distant warehouses and can take anywhere from 24 hours to a few days, and food delivery that relies on real-time meal prep, quick commerce skips both.

They operate through ‘dark stores’ or small, hyperlocal warehouses tucked away in residential neighborhoods. They’re not open to the public and exist solely for rapid picking, packing, and dispatch. Stocked with a curated list of fast-moving essentials, they’re positioned just a few kilometers from high-demand areas. When an order is placed, intelligent dispatch software instantly routes it to warehouse staff and delivery riders. From there, it’s a race against the clock, orders are zipped across neighborhoods on two-wheelers or electric scooters, using route optimization to cut down delivery times to mere minutes.

Quick Commerce Around the World: What Worked, What Didn’t

Turkey pioneered q-commerce when Getir launched in 2015 with a bold 10-minute delivery promise. It was the first to combine dark stores with a full-time rider model, setting the blueprint for the industry. Getir later expanded aggressively into Europe and the U.S., before scaling back operations in 2024 amid mounting costs and operational challenges.

China was an early and aggressive adopter of q-commerce, with JD Daojia and Alibaba’s Freshippo launching in 2015, followed by a flurry of competitors like Meituan in 2018. These platforms normalized 30–60 minute delivery using super apps, dense cities, and smart logistics. COVID-19 accelerated demand, prompting heavy investment in “lightning warehouses.” Driven by platform logistics, dark stores, and hybrid models, China’s quick commerce market is set to cross RMB 1 trillion (US$137B) by 2025. However, intensifying competition and regulatory pressure on labor practices are shifting priorities from speed to sustainability.

Q-commerce never truly scaled in the U.S., where delivery times typically range from 20–45 minutes and ultra-fast fulfillment remains rare. High labor costs, suburban sprawl, and low order density have made it a premium service rather than a daily habit.

Indonesia saw a pandemic-driven q-commerce boom that quickly fizzled. GoTo shut down Tokopedia Now in 2024, citing weak demand and mounting losses. Others followed, either shutting shop or changing direction, as funding dried up and customers pulled back. Astro is one of the few still standing, delivering groceries and household items in 15-30 minutes across parts of Jakarta. But with high costs and thin margins, experts say only players with serious backing and infrastructure are likely to survive.

How India Did It

In 2013, a brand called Grofers was founded in Gurgaon (a fast-growing satellite city bordering India’s capital, New Delhi) by Albinder Dhindsa and Saurabh Kumar. Starting with 90-minute deliveries by linking kirana (neighborhood mom-and-pop shops) stores to urban customers, it quickly gained traction, hitting 30,000 daily orders by 2015 and securing $120 million in funding from global investors like SoftBank.

By 2016, Grofers switched to an inventory-led model. Revenues soared, tripling monthly sales by late 2017. Then came the pandemic and the urgent demand for essentials pushed Indian consumers to embrace localized delivery. By the end of 2021, Grofers had rebranded as Blinkit and was fulfilling over 125,000 orders a day. That shift to sub-30-minute delivery marked the beginning of India’s true q-commerce boom.

What started as a few dark stores in urban metros has become a $7.1 billion industry as of FY2025, up from just $300 million in 2022 - a staggering 24-fold leap, and is projected to reach $35 billion by 2030, marking a transformative shift in consumer retail. And it’s not done yet: India’s q-commerce market is projected to reach $57 billion by 2030, transforming the way urban Indians shop for daily needs, festive essentials, and impulse purchases.

Blinkit is the market leader in India with a market share of 46%, according to Moneycontrol, a popular financial news and information platform.

The Other Players

Zepto, founded in 2021 by two Stanford dropouts, was India’s first purpose-built 10-minute delivery platform. It hit unicorn status in 2023 and now holds 29% market share.

Swiggy Instamart, built on the food delivery giant’s existing logistics, launched in 2020 and captured 25% of the market share by late 2024.

What worked in India’s Favor

Young, Mobile-First Demographics

More than 50% of India’s population is below the age of 30, and most urban consumers primarily use mobile phones for online purchases. They cherish instant gratification, convenience, and digital-first experiences.

Density Economics

In cities like Mumbai and Delhi, one dark store can serve thousands within a 3-5 km radius. The population density is high, and coverage is tight, which means faster fulfillment and fewer kilometers per order.

Relentless Traffic = Strong Reason to Stay Home

Let’s face it, nobody wants to brave Indian traffic for one missing ingredient, especially during the rains and peak hours. Between jams, and erratic travel times, it’s often faster to order online than to walk or drive to the store. Quick commerce wins by saving time and, more importantly, frustration.

Affordable Labor

Quick commerce can only work well when there are boots on the ground. This includes packers, delivery partners. In India, relatively low labor costs have made it possible to scale fast delivery without the sky-high fees often seen in Western markets.

Frictionless Payments

India’s homegrown Unified Payments Interface (UPI) has quietly become the backbone of digital commerce. With over 10 billion monthly transactions, it’s seamless, instant, and embedded into every quick commerce journey.Competitive Pricing

Competitive pricing strategy, along with frequent discounts and promotions, attracts cost-conscious consumers. By offering value for money, platforms like Blinkit have been able to build a loyal customer base.

Localized tech infrastructure

Quick commerce platforms in India were built to run efficiently on low-cost smartphones and patchy mobile networks. Apps are lightweight, support multiple Indian languages, and integrate features like real-time ETAs, live order tracking, and hyperlocal inventory tagging.

E-commerce Giants Vie for a Slice of the Pie

In December 2024, Amazon quietly launched its 10-minute delivery service in select parts of Delhi under its Amazon Now banner, expanding from its earlier pilot in Bengaluru. Backed by a a ₹2,000 crore ($233 million) investment, The e-commerce giant plans to open 300 dark stores across Delhi and the surrounding National Capital Region, Mumbai, and Bengaluru by the end of 2025. While Amazon brings deep pockets, brand recognition, and supply chain muscle, it still trails incumbents Blinkit and Zepto in dark store density and daily order volumes.

Challenges and Criticism

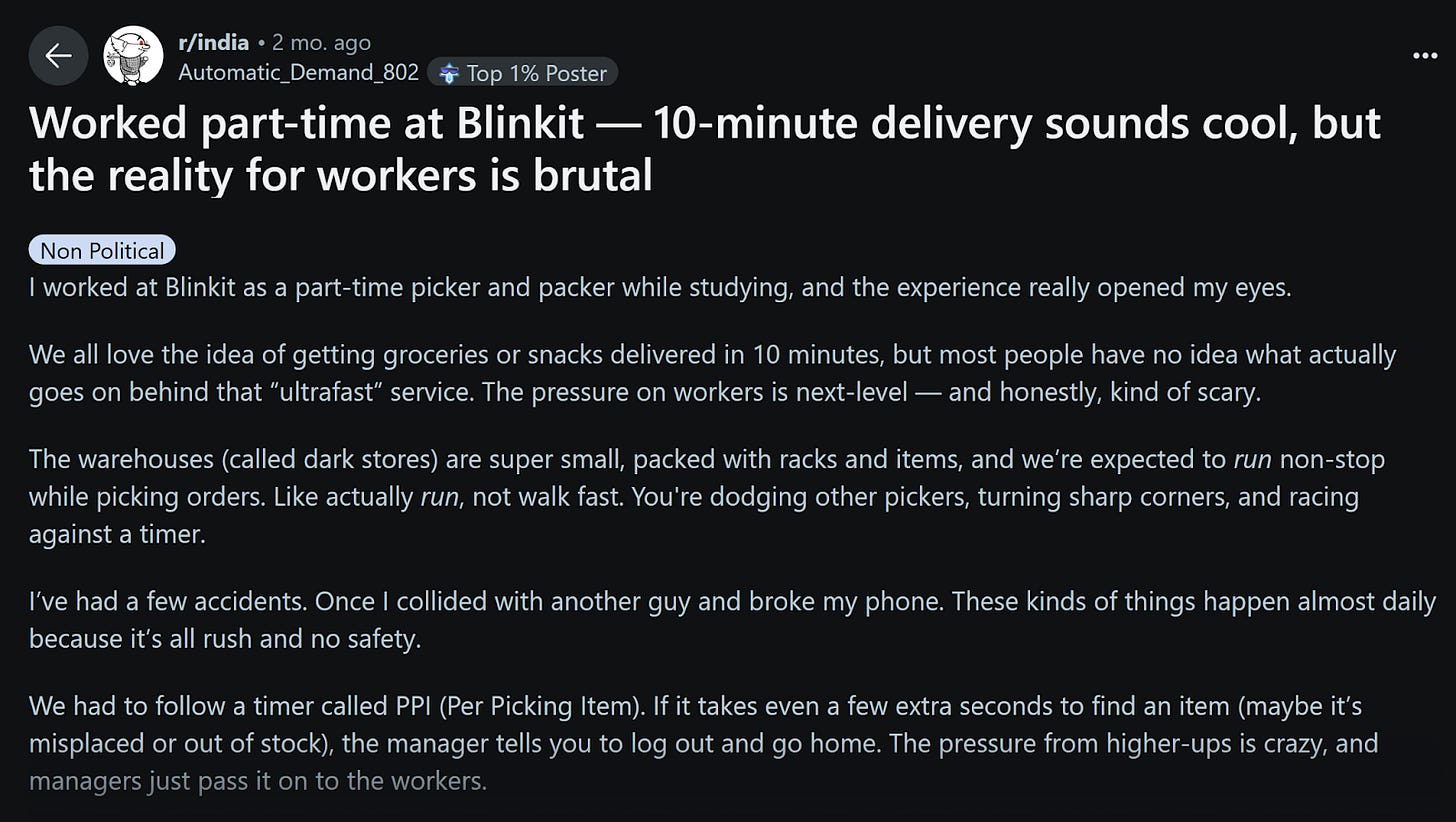

Worker Strain & Safety: Life in dark stores and on delivery routes comes at a human cost. A former Zepto contractual worker described his time there as “psychological warfare”, with no lunch breaks, abusive management, and zero institutional support. A viral Reddit post by an 18-year-old delivery boy in Mumbai, titled "Just a Delivery Boy, But Also Human," detailed climbing stairs, dodging dogs, verbal abuse and even assault. Insurance isn’t much better. A Times of India report found that many agents can't claim accident coverage because their bikes aren't registered for commercial use, and missing paperwork blocks payouts.

Hygiene & Regulatory Pushback: Regulators are tightening oversight. In Pune, the Maharashtra Food and Drug Administration (FDA) suspended Blinkit’s food license in Balewadi following unsanitary conditions and unlicensed operations. A Zepto dark store in Mumbai’s Dharavi was also flagged for fungal growth and expired products.

Environmental & Community Strain: Hyper-local drops mean every kilometer is served by multiple two-wheelers, fueling congestion and last-mile emissions. Riders, racing the clock, increasingly speed, jump signals and mount pavements, leading to a rise in serious injury rates among last-mile workers.

Profitability Still Elusive: Behind the hype, quick commerce remains largely unprofitable. Low average order values, combined with high costs of running dark stores, logistics, technology, and payments, squeeze margins. Platforms burn cash covering operations while rising competition is only intensifying the pressure.

A Growing Workforce, and a Wider Reach

Despite these challenges, India’s quick commerce sector isn’t slowing down. As per TeamLease, the industry currently employs between 250,000 to 300,000 delivery partners and around 70,000 warehouse and store workers - a number set to double by mid-2026. What began as a metro phenomenon is now rapidly expanding into tier II and III cities, driven by better logistics, widespread smartphone access, and evolving consumer habits. Profitability may still be elusive, but India has definitely redefined how instant delivery works - reshaping expectations around speed, convenience, and urban retail.

For More Info on Asia Tech Lens

Nice article.

I’ve been tracking how quick commerce has moved from novelty to expectation in India’s major cities. It is clear this model is redefining consumer habits and brand strategies in real time.