Singapore Invents, Vietnam Deploys: Southeast Asia’s Biotech Corridor Takes Shape

Southeast Asia’s biotech story is no longer about competing hubs, but a specialized corridor

Southeast Asia’s biotech story is no longer about competing hubs, but a specialized Singapore–Vietnam corridor.

Reshaped by tighter capital and harder questions about what actually scales, the region is settling into a division of labor: Singapore is optimized for IP creation and AI-driven discovery, while Vietnam is positioning itself for scale, diagnostics, and applied biotech that can reach large populations faster.

The corridor is already showing up in practice—in how companies finance, validate clinically, and reach patients—not just on paper. The story is no longer about who can become the biotech hub, but about who can make biotech work.

Singapore Is Building Biotech That Public Markets Can Read

The contrast between Singapore and Vietnam becomes clearest when looking at the kinds of biotech companies each market is optimized to produce. Singapore’s strength sits upstream: IP-heavy discovery, platform-led science, and institutional credibility built on decades of investment in research infrastructure and talent.

As funding tightened and late-stage capital became increasingly difficult to secure, several high-profile clinical-stage companies faced financial pressures. Cell therapy player Tessa Therapeutics moved toward liquidation after failing to raise additional funding, while ASLAN Pharmaceuticals filed for voluntary liquidation of its Singapore operating subsidiary in 2024 amid cash runway constraints.

The result has been a shift toward a more sustainable approach, where success increasingly comes through licensing, partnerships, and capital market exits rather than trying to manufacture a single national biotech giant.

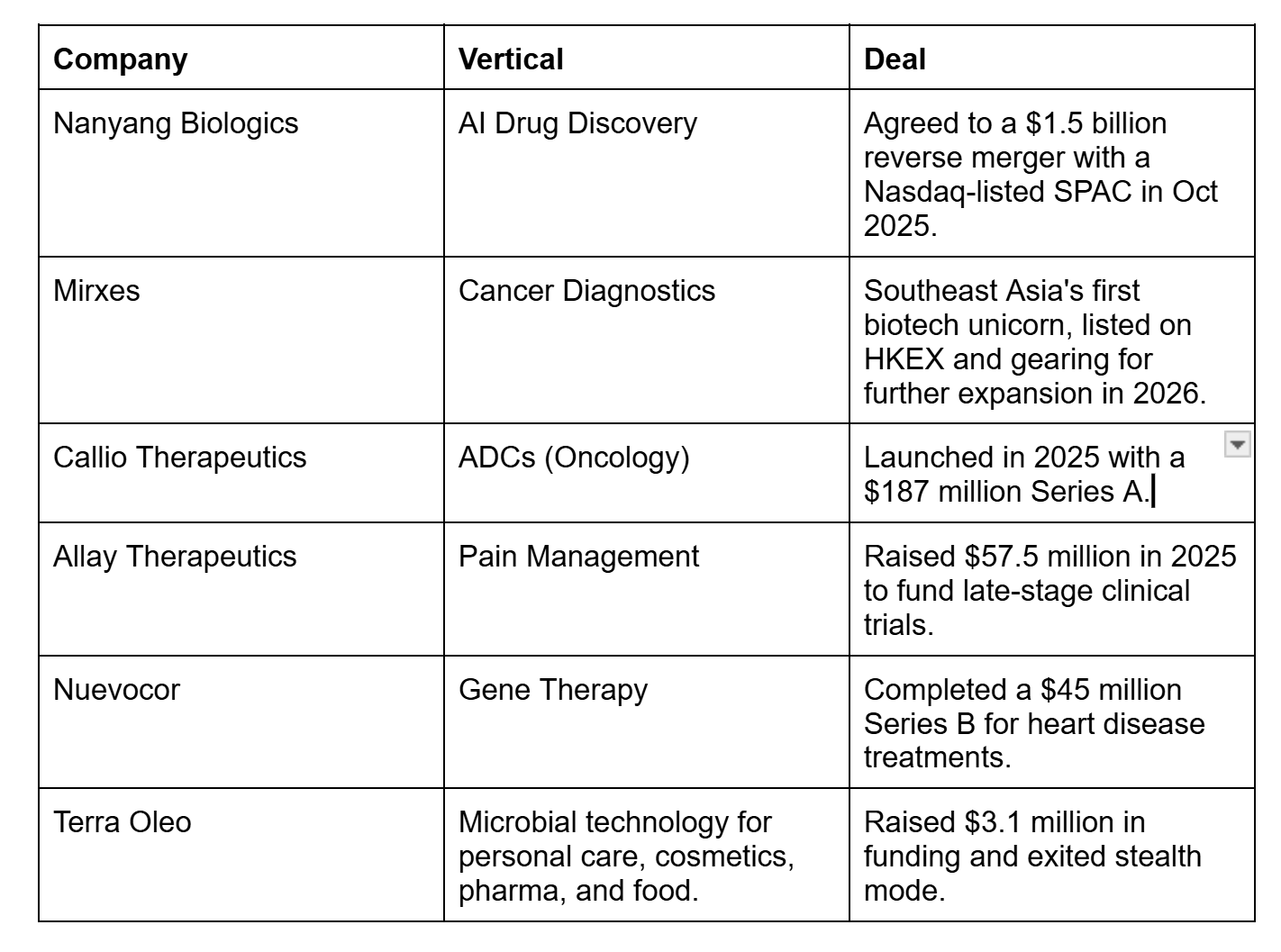

For instance, companies like Nanyang Biologics are built with global capital in mind from the outset. Meanwhile, Mirxes’ Hong Kong listing in May 2025, which pushed it past a US$1 billion valuation, demonstrates that the city-state can still produce biotech outcomes that meet international investor standards in a more selective era.

In practice, that means clearer IP narratives, governance and trial plans investors can diligence, and earlier alignment with exit pathways like licensing or listings.

Vietnam Can Scale Diagnostics—But The Plumbing Decides

Vietnam’s edge sits on the other side of the value chain. It is not “lower-cost Singapore,” but a market where biotech can become operational, with large patient pools, rising demand for screening, and distribution pathways that can make diagnostics and applied biotech scale faster than novel therapeutics.

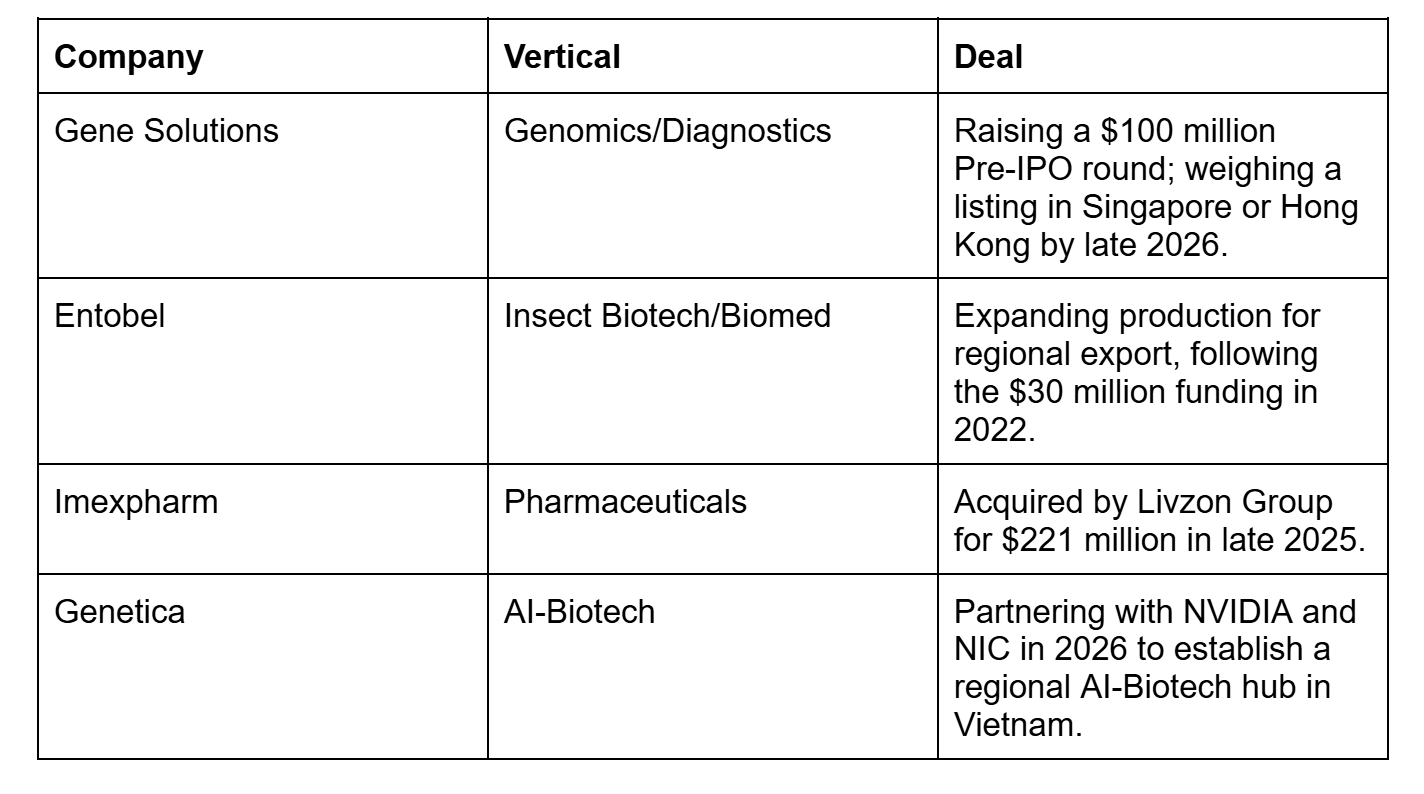

The corridor is showing how capital, clinical research, and market access are being stitched together across borders. Vietnam-based Gene Solutions, for example, is seeking a US$100 million pre-IPO round and has signalled a regional listing ambition as early as 2026, linking Singapore’s capital markets with Vietnam’s deployment logic.

Institutionally, Vietnam is also pushing to upgrade its clinical trial capacity. A roadmap by Oxford University Clinical Research Unit (OUCRU) calls for streamlined regulation, stronger infrastructure, and alignment with international best practices. Its director, Prof. Guy Thwaites, has argued that this kind of strategic alignment could help position Vietnam as a more competitive regional destination for clinical research.

However, the opportunity comes with real constraints. Vietnam’s biotech ecosystem still faces uneven access to capital, gaps in commercialization infrastructure, and unclear reimbursement rules that can slow adoption beyond major urban centers.

Industrial Biotech Is The Corridor’s Second Lane

Beyond healthcare, industrial biotech is beginning to widen the Singapore–Vietnam corridor. Bio-based materials, skin care ingredients, and agricultural inputs can scale on supply chain demand, which makes them one of the region’s more practical biotech paths while funding is tighter.

Singapore’s strength lies upstream, in enzyme engineering and synthetic biology platforms that generate new processes and compounds.

Vietnam’s role is more downstream, where agriculture and manufacturing demand are already moving toward bio-based inputs. For example, Vietnam has become a leading market in Southeast Asia for registered and used biological pesticides, a signal that bio-input adoption can reach commercial scale.

It mirrors the same corridor dynamic: R&D and process innovation upstream, and real-economy adoption downstream.

This keeps the corridor logic intact: Singapore supplies capability while Vietnam supplies real economy demand.

Why Now, and What It Means

The timing matters. Global biotech capital has become more selective, pushing founders and governments to focus on execution rather than ambition alone. In Singapore, that has translated into a tighter focus and clearer exit paths. In Vietnam, it has sharpened attention on deployment, clinical readiness, and commercialization infrastructure.

Governments across Southeast Asia are also getting more explicit about outcomes, from anchoring discovery to attracting clinical trials and scaling applied biotech. Paired with cost advantages, large patient pools, and rising healthcare needs, the region is starting to look less like a follower of Western biotech models and more like a system with its own logic.

As Prem Mandalapu, general manager for commercial ASEAN at Cytiva, has noted, many small and medium biotech ventures in Southeast Asia still face hurdles around talent, resources, and scaling innovations to market. Collaboration between government, academia, and industry, he argues, is essential to strengthening the ecosystem.

If the corridor holds, Southeast Asia’s biotech story won’t be about a single hub. It will be about whether the region can connect invention to deployment faster than capital patience runs out.

Related Reading On Asia Tech Lens

Singapore Redefines Longevity Through Biotech Bets

Singapore’s longevity push shows how the city-state turns public R&D and diagnostics talent into investable biotech outcomes.

China’s Biotech Ambitions Find a Springboard in Southeast Asia

A regional view of how Singapore functions as a trusted launchpad while Southeast Asia becomes the proving ground for scale and rollout.

Lost Vision, Found Mission: How Mediwhale’s AI Sees Disease Before Doctors

A concrete case study of AI-meets-diagnostics, and what it takes to translate medical insight into scalable health outcomes in Asia.

Singapore’s Robots Don’t Go Viral—They Go Global

A strong parallel to “invent vs deploy”: Singapore builds reliable, exportable deep-tech stacks that only scale once they leave the domestic market.

Singapore’s Deep-Tech Strategy Needs a Contrarian Reset

A sharper frame on why Singapore’s real edge may be “orchestration”: capital, governance, and IP—while deployments happen in larger regional markets

The shift from hub competition to corridor specialization feels like a maturer take on regional development. Gene Solutions' planned listing really shows how this is working in practise - Singapore provides the capital market infrastructure while Vietnam brings patient scale. What Im wondering is whether this model holds when regulatory harmonization becomes more critical, especially for therapeutics versus diagnostics. The timing argument is sharp tho - tighter capital definitely forces clearer value propositions.